.webp)

Controlled Environment Agriculture: Opportunities and Challenges for Investors

Background

Controlled Environment Agriculture

Vertical Farming, Indoor Ag, Aquaponics, Hydroponics… there are a lot of terms thrown around in this segment. At Re:food, we refer to any means of tech-enabled indoor crop production as Controlled Environment Agriculture (CEA), which we break into two sub-segments:

- Vertical Farms involve completely controlled environments, with growing trays packed in racking tightly from the floor all the way to the ceiling. LED lighting, tight climate controls, and specialized irrigation systems create optimal growing conditions. Together, these help turbocharge crop growth rates relative to conventional and greenhouse farming.

- Greenhouses are semi-controlled environments where growth areas are covered with transparent materials (glass or even plastic), allowing sunlight to pass through and trapping heat for optimal growing conditions. They can range in sophistication from simple polytunnels to more expensive medium and high-tech facilities that include greater levels of monitoring, environmental control, automation, and, ultimately, productivity and consistency.

Within each sub-segment, we’ve further divided companies into one of three areas:

- Operators are producers of crops who manage the day-to-day operations of CEA facilities and generally also engage in marketing and selling the produce; for example, Oishii, Soli Organics, and NatureSweet.

- System Sellers are providers of the crop-growing infrastructure operators or home enthusiasts use to grow the crops. Examples include Vertical Future and Intelligent Growth Solutions (IGS).

- Technology Providers are hardware and software solutions providers that aim to improve efficiency and reduce operator costs. Examples include Iunu, Sollum, and LettUs Grow.

Is CEA sustainable?

The answer is generally “yes” but may vary from site to site. The impact side of CEA has many angles. On the environmental side, CEA promises to reduce inputs (water, nutrients) through closed-loop systems with significantly lower leakage than open systems. At the same time, CEA systems often require a high energy input to operate. One research study comparing hydroponic lettuce production to conventional found that the hydroponic system resulted in water savings of 230L per kg yield compared to the conventional growing method. At the same time, the hydroponic system required 82 kJ energy per kg more than the conventional system. Given the high energy requirements, CEA operators must consider location and access to renewable energy to maximize these systems' environmental benefits.

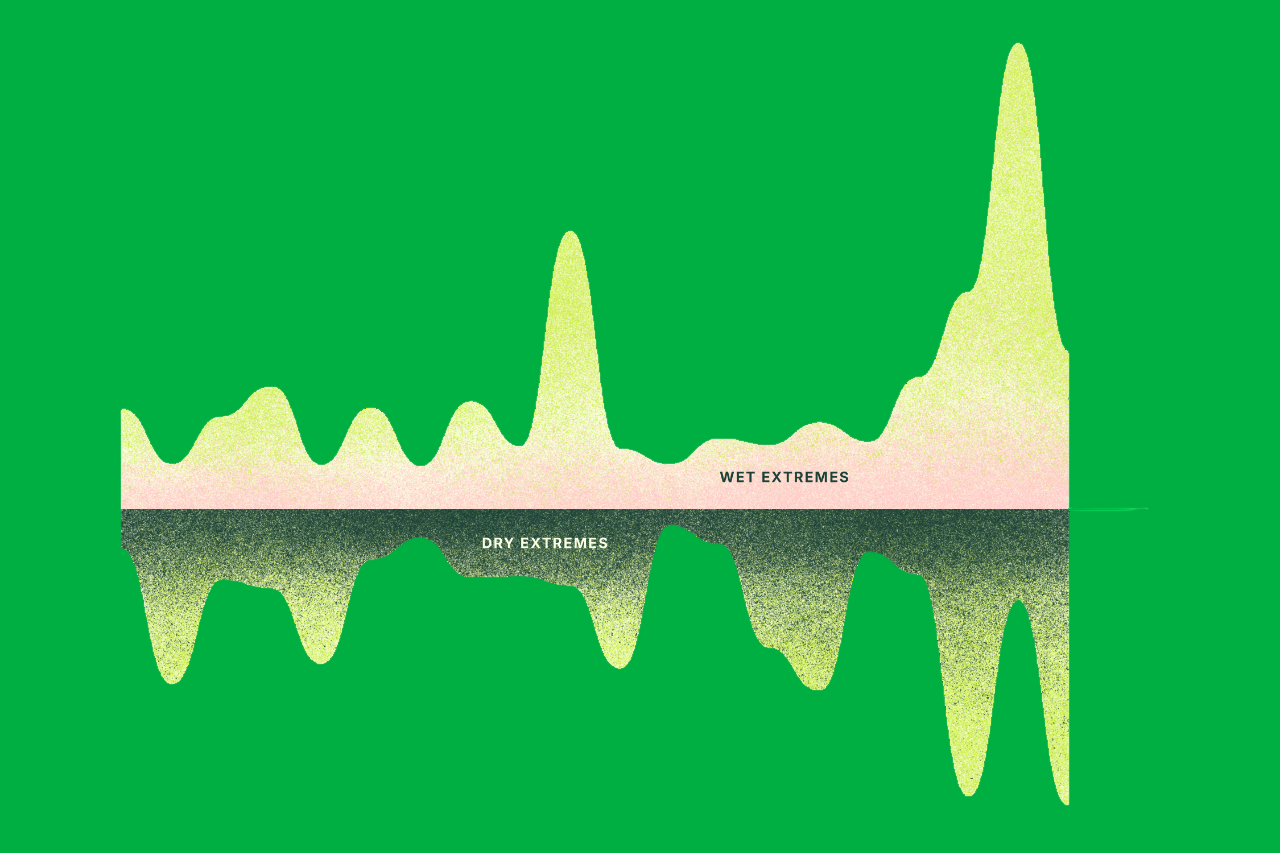

At the same time, CEA is an essential climate adaptation technology. As global warming exacerbates severe weather events and changes growing zones, indoor agriculture can help future-proof our food supply and ensure everyone has reliable access to healthy produce. CEA can decrease the dependency on global supply chains, which is important in regions such as the Middle East and Singapore. CEA's role in food security and supply chain resilience should not be overlooked.

Market Views

CEA has gained prominence over the past few years, but it’s share of arable less is marginal — in North America less than 0.05%. Greenhouses still comprise most of the CEA market today and will continue to do so. They are substantially cheaper to build than vertical farms and only marginally less profitable per acre. Moreover, their profitability has been proven over many decades, whereas vertical farming companies have yet to prove that they can consistently deliver on promised unit economics at scale. As a result, when interest rates rose and VC funding dried up, several companies failed to adjust their trajectories and cash burn or attract sufficient amounts of capital from other dilutive and non-dilutive sources to survive.

A few years on, we have seen three consequences:

- Capital left the CEA category

- There was a shift of capital deployed from vertical farming to greenhouses

- The challenging market conditions typically strengthened surviving companies

Today, there is a case for cautious optimism for the CEA industry.

Our Insights

So where does that all leave the segment, and where does it leave growth equity investors like Re:food?

Competitive Advantage and Profitability

We’re not going to be contrarians on this point – to prove that this segment is viable for investments, Operators will first need to prove that they can get to and maintain profitability. This will then provide stability to a more nascent B2B ecosystem.

To prove that this segment is viable for investments, Operators will first need to prove that they can get to and maintain profitability.

Many Operators are playing in highly commoditized markets and in a narrow subset of crops like herbs and leafy greens where competition is increasing or already high. At the same time, input costs, especially energy and labor, can make or break unit economics. Some approaches that could give us confidence in an Operator’s forecasted path to profitability:

- Crop Selection: diversification into higher-value or less competitive crops. This includes specialty crops under threat from climate change as well as proprietary innovations that consumers value, such as seedless peppers from NatureSweet, a Texas-based producer of greenhouse vegetables, and our portfolio company Vanilla Vida.

- Site Selection involves access to inputs at reliable and affordable prices. On the energy side, low-cost renewable energy is critical to achieving attractive unit economics and ensuring a positive environmental impact.

- Technology and Automation: Many operators seek to integrate vertically. However, future winners will likely design flexible systems that retrofit existing facilities with emerging innovations (including integrated hardware and software) from system sellers and technology providers.

Access to Capital

Winning operators in this space need access to capital other than venture funding. We’re monitoring lower-cost forms of capital that have started to back the space for strategic and financial reasons. This includes non-dilutive financing (for example, US government programs looking to bring in innovation and jobs), national governments looking to invest in food sovereignty (for example, Saudi Arabia and Singapore), and even infrastructure funds looking for particular exposures, such as solar farms or underlying real estate assets (e.g. prime warehouses). Successfully diversifying the capital stack will incentivize equity investors to return to the segment by reducing financing risk and lifting expected returns.

What’s the takeaway?

We’re actively monitoring the segment, looking for signs that vertical farming operators have achieved the kind of robust unit economics that will be able to support project finance and, eventually, infrastructure funding. Until then, we continue to support our portfolio company Vanilla Vida while reviewing various greenhouse opportunities (medium and high-tech) and looking for Technology Providers with a step-change value proposition that can serve both greenhouses and vertical farms.

Are you interested to learn more about our work? Do you agree with our conclusion, or think we’re missing something crucial? No matter what, we want to hear from you! Reach out to us at solvable@refood.co.